life insurance face amount vs death benefit

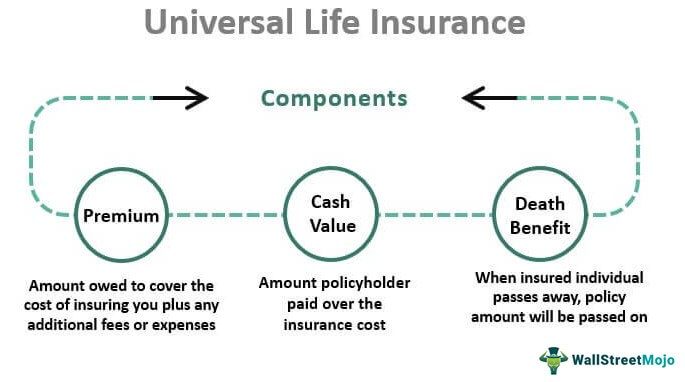

Universal life insurance allows policy owners to rather easily make adjustments to the death benefit or face amount of their policies. Typical cash value targets will be 1 or to endow to be worth the initial face amount in cash at either age 100 or age 120.

Most Shocking Life Insurance Facts And Statistics Infographic Life Insurance Facts Life Insurance Quotes Life Insurance Marketing

The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your heirs.

. Face Amount vs Death Benefit. When the insured of an active insurance policy dies the insurance company has the obligation to pay out the face amount of insurance. This is the dollar amount that the policy owners beneficiaries will receive upon the insureds death.

The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies. Options start at 995 per month. The main benefits conferred by these policies are cash value savings and death benefit proceeds.

Look To Us For Cheap Term Life Insurance That Financially Protects Those You Care About. In a lot of insurance policies there is an added benefit of riders that the policyholder may add to their existing policy. At the beginning of the policy the face value and the death benefit are the same.

In some cases the. This is often far more easily accomplished with universal life insurance than with whole life insurance. How much and a what age.

Keep in mind that face amount and paid death benefits are similar. Ad Flexible Payment Options. Compare Life Insurance Rates Companies.

I want to note that a universal life insurance death benefit option is different from a death benefit amount change. The face amount of a life insurance policy is frequently the same as its death benefit. Ad Our Chart Makes Life Insurance Comparison Simple.

This death benefit equals the cash value plus the death benefit your policy was issued with. The Most Reliable Providers That Have Your Back. By the same token if it would take 800000 to replace the economic support the man offers his family then the life insurance agent will insist the man get a policy with this amount of death benefit coverage.

It is true that the face amount is the death benefit but the death benefit may not always be equal to the face amount. If you decide to borrow money from your whole life or universal life insurance policy your coverage will not be terminated unless you decide to terminate it. You cant be turned down due to health.

This face amount can be set or changeable depending on the type of contract held. This type of policy tends to be more expensive since your cash value isnt used to offset insurance costs. The face value does not always equal the death benefit particularly when you are dealing with permanent coverage such as whole life insurance that has accompanying riders such as PUA riders and term riders and also has life insurance dividends that can increase the.

All life insurance policies have a face amount which is also called the death benefit this is the amount thats paid to your beneficiaries after you die. The exact face value of your life insurance policy will depend on how much coverage you bought. Incidentally to say that the death benefit replaces the man obviously doesnt mean in a full literal sense.

The face value of a life insurance policy is the death benefit. The face amount and thereby the death benefit can change for a number of reasons but it is much more difficult to increase a death benefit substantially than to decrease it in most circumstances. Ad Get an instant personalized quote and apply online today.

For example if the face value of your permanent life insurance policy is 100000 and you borrowed 5000 against the loan your. A structure of an increasing death benefit UL and cost will depend on the assumption of the target case value. The concept of the death benefit is quite simple.

But only permanent life insurance policies have cash value which functions similar to a savings or investment account that you can use while youre still alive. Your beneficiary does receive the cash value in this case. In this case the death benefit increases as the cash value does.

See your rate and apply now. The face amount can be changed in some instances though its generally easier to reduce the face amount than to increase it. Speak With A Licensed Rep Now.

It remains at the same level from the beginning of the insurance contract until the end. The face value never changes. Rates starting at 11 a month.

It can also be referred to as the death benefit or the face amount of life insurance. What is the Face Amount of Life Insurance. The term death benefit can also be referred to as the DB or simply the benefit.

Apply for guaranteed acceptance life insurance. Updated Jan 21 2021. Face value is different from cash value which is the amount you receive when you surrender your policy if you have a permanent type of life insurance.

Trusted By 1000000 Americans. 2 The face value of life insurance is the dollar amount equated to the worth of your policy. A permanent life insurance policy has a face value also known as the death benefit.

Whole life the high quality ones age guaranteed to endow at age 100. If you bought 1 million in life insurance coverage your policys face value is 1 million which is also how much your beneficiaries will. Face value is calculated by adding the death benefit with any rider benefits and subtracting any loans youve.

However as time goes by they can begin to diverge. Find the Best Policy For You Save. The death benefit can also be defined as the face value or face amount of a life insurance policy.

When you purchase a life insurance policy you pay premiums to a life insurance company in order to protect your family from the financial burden associated with estate taxes funeral costs and the loss of your income. Ad Youre eligible to apply for exclusive term life insurance from New York Life. However taking a loan out against your policy will reduce the death benefit.

The death benefit is the actual amount the carrier pays your beneficiaries and you can tack on additional benefits with riders. The initial amount of money claimed by the beneficiaries on account of the death of the insured person that is mentioned in the contract is the actual face amount. They both reflect the amount of money that the insurance company will pay out in the case of a valid claim.

Most life insurance policies intend to provide financial protection for loved ones after you pass. For example a rider added to the policy that the death benefit will double in case of a certain type of accidental death. The face amount is the initial amount of money which is stated on the face of the contract that will be paid in a death claim.

Locate the schedule of benefits that summarizes the benefits that your beneficiary is entitled to in the event of your death. Total the value of the benefits that will be paid to.

Cash Value And Cash Surrender Value Explained Life Insurance

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Cash Value And Cash Surrender Value Explained Life Insurance

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

Life Vs Health Insurance Choosing What To Buy

What Are Paid Up Additions Pua In Life Insurance

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

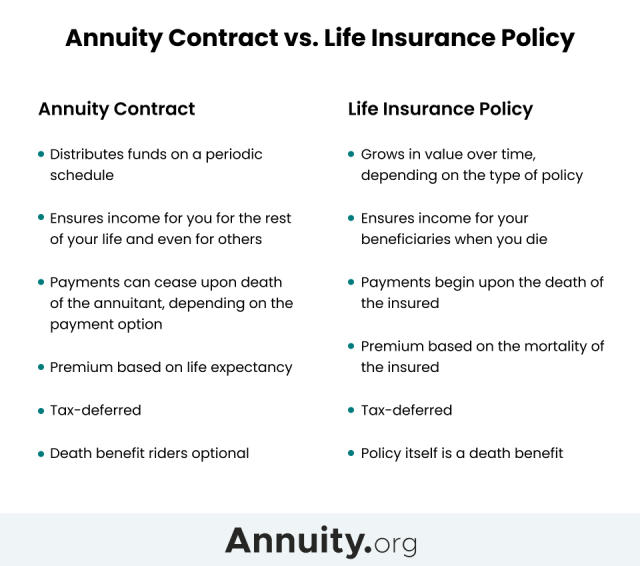

Annuity Vs Life Insurance Similar Contracts Different Goals

Pin On Outline Financial Infographic

Cash Value And Cash Surrender Value Explained Life Insurance

Pin On Insurance Marketing Humor Estate Planning Chronic Critical Illness Annuities Tax Savvy Make Money

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

Universal Life Insurance Definition Explanation Pros Cons

Term Vs Whole Life Insurance 2022 Guide Definition Pros Cons

Cash Value Life Insurance Life Insurance Life Insurance Agent Insurance Policy

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

What Are Paid Up Additions Pua In Life Insurance

Cash Value And Cash Surrender Value Explained Life Insurance